DeFi. Chances are, if you’ve spent any time around the cryptocurrency space the term ‘DeFi’ will have cropped up. Defined as ‘Decentralized Finance’, DeFi is an ecosystem made up of financial smart contracts, digital assets and decentralized applications (DApps) built on top of a blockchain protocol. As a result DeFi’s potential, decentralized finance is shaping up to become the poster child of Ethereum Cypherpunks and permissionless app builders everywhere.

In this article we’ll be taking a look at the rise of DeFi in 2019, and a new breed of lossless, cryptocurrency lotteries.

Article Contents:

- 1. DeFi in Numbers

- 2. Lossless Lotteries - PoolTogether

- 3. Compound Finance Magic

- 4. Transparency and Trust

- 5. The Future of Decentralized Finance and Betting

- 6. Conclusion

DeFi in Numbers

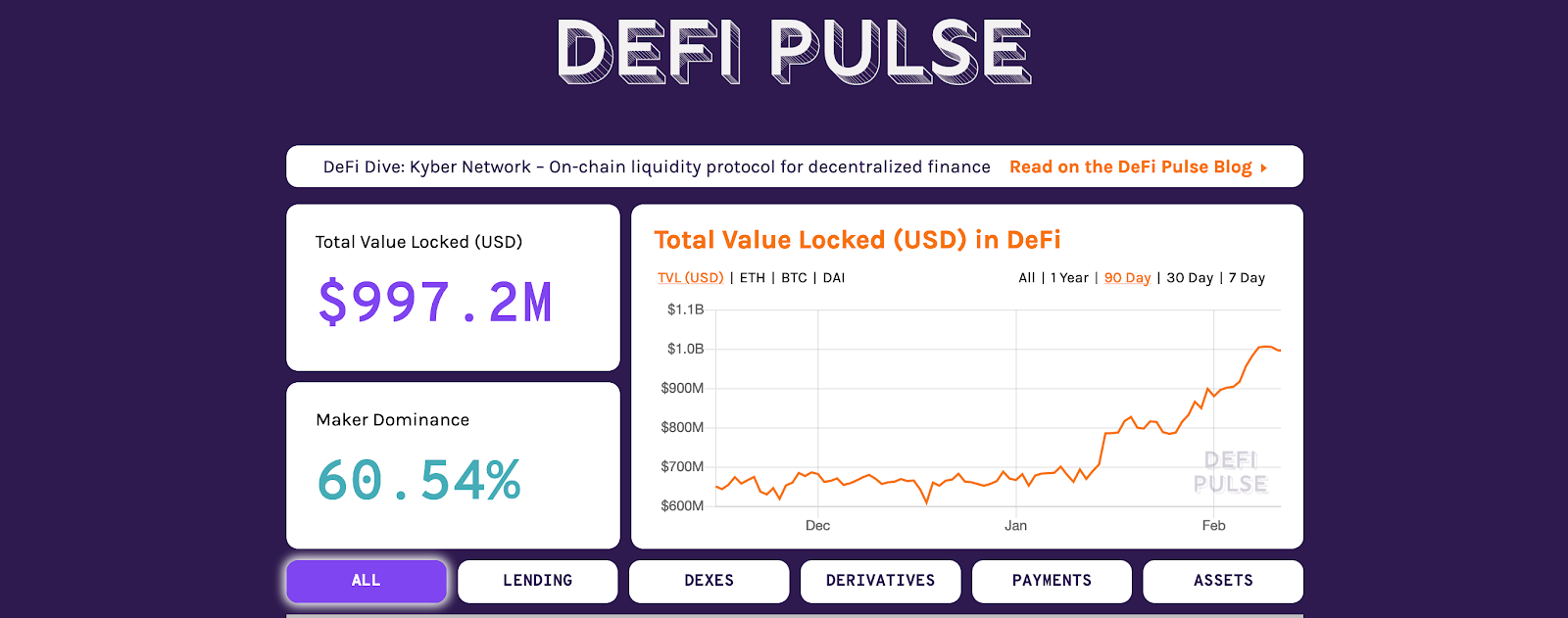

2019 saw an incredible increase in the value of digital USD locked up within DeFi applications. A market summary of total assets presents a compelling narrative.

Market Summary - Key Figures

- $1 billion total value locked into smart contracts

- Ethereum dominates as protocol-of-choice

- Lending makes up over 80% of total market value

- Maker leads market share with $600 million (2.4m ETH) total

- Synthetix largest derivatives platform with $130 million (610k ETH) total

source: DeFI Pulse

With Ethereum-based financial applications gaining significant real-world traction and market share, the expansion of product services looks set to continue increasing exponentially.

Lossless Lotteries - PoolTogether

The very phrase ‘lossless lottery’ might evoke cynicism from even the most die-hard positivist. However, the potential of decentralized, automated smart contracts means that a lossless lottery isn’t just possible, but already exists.

PoolTogether, built on Ethereum, offers users the potential to deposit digital dollars into a collective funding pool, and receive lottery tokens in return.

The venture describes itself as a ‘revolutionary no loss lottery’, where ticket holders receive a full refund of their funds if they don’t win. Auto-refund mechanisms scratch at just the surface potential of lossless DeFi lotteries, however.

Let’s examine how PoolTogether, and other lossless lotteries built on Ethereum, work in full.

- Users deposit Dai into a pool to receive tickets, with tickets entering the holders into a prize draw.

- Interest on the pooled Dai accumulates. Prizes generated exclusively through the interest earned (and additional fund sponsorship).

- At the end of each draw, one holder wins all of the interest via a selection algorithm.

- Savings and/or winnings withdrawable at any time.

The current interest-based prize for PoolTogether total stands at $1,497 per week, with over $979,000 Dai in escrow. Most importantly, 1 Dai = 1 US Dollar. This gives potential ticket holders the opportunity cost to win $1,497 per week for 1 refundable US Dollar (with odds calculated as total Dai/number of personal tickets).

Compound Finance Magic

Still sound too good to be true? We don’t blame you. However, through compounding the interest and leveraging the Compound protocol, Ethereum financial applications are enabling users to pool digital money, earn interest, and borrow assets. In providing an autonomous borrowing layer - the Compound protocol has created a decentralized marketplace for users to supply liquidity, generate interest, and borrow directly from the market.

Interest rates are determined via algorithms and accrue every Ethereum block, with available market liquidity forming an essential part of the calculation of interest. Compounding in this way allows DApps, such as PoolTogether, to securely collect Dai, generate interest, and automatically deliver the weekly gains to a winner.

Transparency and Trust

Building a decentralized interest-earning/distribution Dai pool allows for pubic auditing of accounts. Moreover, users funds are protected by the automatic execution of pre-defined smart contractual conditions. Aside from an unprecedented rollback of the Ethereum network, the fund pools should remain secure.

Indeed, DeFi promises significantly more transparency (and innovation) in comparison to financial legacy efforts. With US citizens spending $80 billion dollars per year on lottery tickets year alone, the market-share opportunity for fairer, accessible, and incentivised finance applications is potentially limitless.

The Future of Decentralized Finance and Betting

What are the ramifications of decentralized lotteries on traditional betting markets?

For starters, the very philosophy of zero-sum markets (such as traditional lotteries/betting exchanges) could very well be a thing of the past. Bookies already offer refund promotions/bet protection on qualifying bets. It doesn’t take too much imagination to conjure up different approaches to the very foundations of how we think about betting - with Ethereum’s Augur being just one example.

Could it be that in the very near future crypto-based betting exchanges offer smaller, regular returns, but with the added security of a partial/full auditable refund? Would it even be possible to create a Dai-pooling betting/lottery hybrid, whereby the interest and profits generated from bets are distributed to token holders as a form of digital dividend? The iterations and possibilities are limitless.

Conclusion

Innovative development of DeFi products on top of the Ethereum network certainly holds promise for a great many decentralized financial service applications.

With recent news of a ‘flash loan’ exploitation demonstrating the need for caution when deploying novel technological networks, wide-spread public adoption of DeFi is unlikely to be straightforward or pain free.

Guides and Feature Articles Similar to this Topic